What will we learn about Alliance Leisure’s acquisition of Diamond Comcis at a chapter public sale, and what it means for comics publishers, as reported this morning?

Spoiler: Not a lot, because it’s early days, and the court docket should approve the sale. However some issues have emerged.

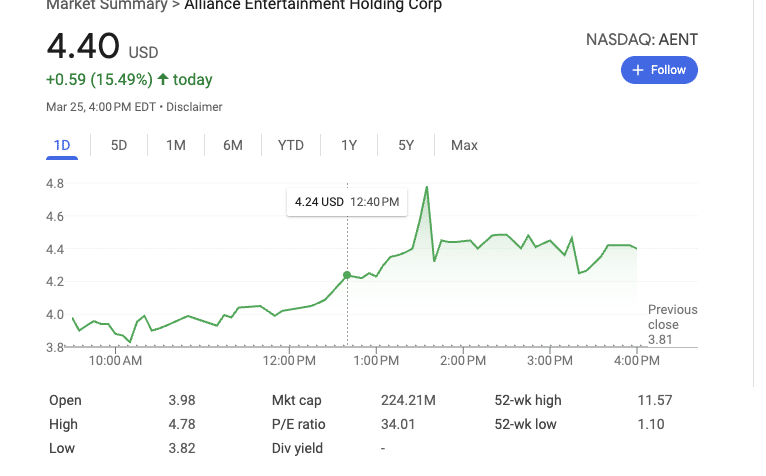

Buyers favored the transfer from Alliance to buy a significant distributor of toys, video games and, oh sure, comics. Their inventory was up as a lot as 15% and their market cap elevated from $200 million to $225 million simply from the time the acquisition was introduced. In line with a promotional tweet the transfer

• Provides $200M+ in anticipated income & $10M+ EBITDA in FY2026• Deepens presence throughout comics, video games, and collectibles with 5,000+ retail accounts• Unlocks cross-channel synergies with fan-favorite IPs (@Marvel, @Pokemon, D&D)• Financed through amended credit score facility—capital-light growth technique

Alliance already had a $120 million credit score line which they expanded to $160 million to finance the acquisition. Provided that Common had put in a bid of $36 million for Diamond UK alone, you get an concept of the scale of the acquisition value.

We reached out to our uncommon suspect comics insiders and retailers about Alliance Leisure, however the firm is just about an unknown for the common comics store. As a distributor they’ve specialised in audio and residential leisure, whereas extra just lately branching out into extra popular culture targeted merchandise, as you’ll see in the event you proceed studying. Basic feeling was cautiously optimistic to no concept.

Right here’s some learnings gleaned from a day of Yahoo Finance search. (Please notice, that Alliance Leisure is publicly traded at AENT, so there’s plenty of info to pour by.)

Alliance is run by CEO Jeff Walker and Govt Chairman Bruce Ogilvie, who each come from origins within the music trade. The corporate’s web site lists it as “worker owned” through a 2023 incentive inventory plan, which is when the corporate went public, and a photograph of workers standing in entrance of a warehouse will really feel acquainted to some. Walker’s story is through the Alliance Our Story web page, He obtained is begin on the CD Listening Bar and has run Alliance for 34 years.Ogilvie’s CV from LinkedIn:

Began Abbey Highway Distributors in 1980, Bought Abbey Highway in 1994. Grew to become CEO of Warehouse Music in 1996 and introduced Warehouse out of chapter. Joined Tremendous D in 2001 as CEO, bought Alliance Leisure in 2013 and consolidated Tremendous D with Alliance Leisure and have become Chairman. Bought ANconnect from Anderson in 2016. Acquired Mecca Electronics in 2018. Acquired Distribution Options from Sony Footage 2018. Acquired Mill Creek 2019. Acquired Recreation Fly 2019. Merged with COKeM Worldwide in 2020. Merged with Adara in 2023, and listed on Nasdaq underneath AENT

In recent times, the corporate has run on a “progress by acquisition” plan, which incorporates Mecca Electronics, COKeM Worldwide, Mill Creek, AN Join and Distribution Options.

Most intriguingly for the current inquiry, just some months in the past Alliance acquired Handmade by Robots, a Funko-esque firm, whose acquisition would “launch us into the licensed collectible enterprise, leveraging our robust relationships with leisure licensors to create a variety of iconic characters.”

In line with the pr for that transfer:

With Handmade by Robots now a part of its portfolio, Alliance Leisure plans to give attention to producing a curated choice of top-tier licensed merchandise that includes essentially the most well-known and beloved characters from films, TV, music artists, video video games, and anime. By leveraging Alliance’s in depth distribution community and partnerships with main retailers similar to Costco, Walmart, Goal, and Scorching Subject, in addition to ecommerce retailers like Amazon, eBay, SHEIN, and extra, the corporate is poised to considerably broaden the attain and visibility of Handmade by Robots’ distinctive collectible line. Alliance may even promote globally to its prospects positioned in 72 international locations.

Given this route, buying Diamond Choose Toys makes a plenty of sense, as does gaining access to the direct market of 2000-3000 comics retailers.

There’s much more numbers on this inventory evaluation web page, which studies:

The strategic rationale facilities on three worth drivers: product portfolio growth, buyer base diversification, and operational synergies. By including 15,000+ SKUs and relationships with 5,000+ retail storefronts, AENT positive aspects speedy scale. Extra importantly, the cross-selling potential between mass retailers and specialty channels creates a compelling income progress narrative.

The collectibles and tabletop gaming markets sometimes command greater margins than conventional media distribution, probably enhancing AENT’s profitability profile. The addition of Collectible Grading Authority introduces a high-value service part that would additional strengthen margins.

But it surely’s not all sunshine and roses. In line with the 2Q earnings submitting, income was down

Income: $393.7 million, a 7.5% lower in comparison with the identical quarter within the earlier fiscal 12 months. ?

Internet Revenue: $7.1 million, or $0.14 per diluted share, down from $8.9 million, or $0.18 per diluted share, in Q2 FY24.

Gross Revenue: $47.7 million, representing a 128% enhance, attributed to a worthwhile gross sales technique. ?

The Diamond acquisition will probably increase these numbers.

But you’ll discover one phrase is considerably absent from all this evaluation and submitting: comics. Simply wanting from the skin it appears this deal was about toys and video games and storefronts and never concerning the very low margin indie comics distro enterprise. For the final phrase I flip to Milton Griepp, who has the perfect 10,000 foot view, put succinctly:

Alliance is the sort of well-financed, well-managed firm that has the sources to remodel and modernize the comics and sport distribution companies it’s buying (see “World In line with Griepp”).

Certainly, all our sleuthing this afternoon revealed an organization with good communication, a transparent technique, and plenty of sources. I’d guess that Diamond’s toy and sport companies are simply high quality and can even see extra sources put into them.

And the comics? Because the comics trade has been bracing for Diamond going away fully, massive ships have discovered a port within the storm. However what about all of the skiffs and dingies? Effectively, extra to return on that.